As creatives and entrepreneurs, we have big dreams, and sometimes it can feel like a daunting task to make them come true. We often focus on the “how” of our business more than the “why.” How do I pay bills? How do I market my product or service? How do I set up shop? But what about why we’re doing this in the first place? This is where paying yourself first comes into play.

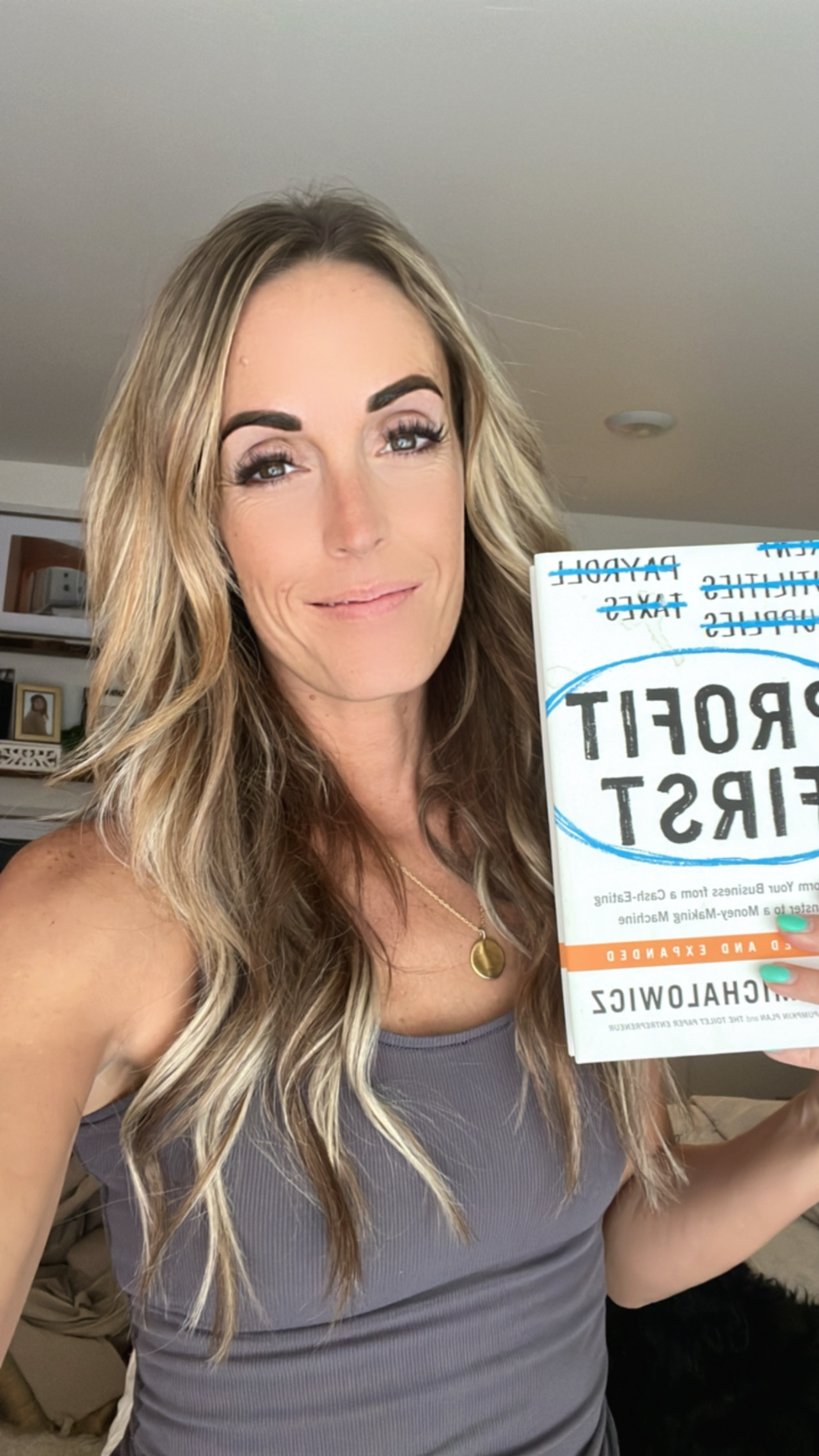

Mike Michalowicz, an incredible author who wrote the book Profit First, had some really great advice that I started to implement into my business many years ago. Paying myself first and evaluating my expenses with a careful eye to ensure that there are funds available time and time again to continue paying myself before all else.

If you haven’t read his book, grab it and continue reading on for some of the advice that I took from the book.

What Does Paying Yourself First Mean?

Paying yourself first means putting your financial needs ahead of everything else. It means taking care of yourself financially before worrying about bills, taxes, or clients. It means having enough money saved up so that when unexpected expenses arise, you are prepared and not left scrambling to figure out how to cover them. It also means having funds set aside for retirement, vacations, or any other goals that you may have.

How Do I Set Up My Business to Do This?

Setting up your business to pay yourself first can be tricky but it doesn’t have to be overwhelming. Here are some tips for setting up your business so that you can easily pay yourself first:

Start with a budget

Before anything else, create a budget for your business that includes an allocated amount for yourself each month that goes directly into savings. This will help ensure you’re getting paid every month even if you don’t have any clients lined up!

Automate payments

Once you have a budget in place, automate as much of your finances as possible so that payments are coming out of your accounts automatically each month without having to think twice about it. Automation makes it easier to stick with a budget since there won’t be any temptation to spend extra money on something else. This will also help keep track of expenses and make sure nothing falls through the cracks!

Invest in yourself

Investing in yourself is just as important as investing in your business! Take classes or workshops related to what you do; attend networking events; hire an accountant; get advice from mentors; build relationships with other creatives—all these things will help grow your career and give back financially down the line!

Set up an emergency fund

Your eventual goal is to have enough money in this account for eight months’ worth of living expenses with no income. Early on, though, try to just put together one month’s worth.

Profit must be baked into your business. Every day, every transaction, every moment. Profit is not an event. Profit is a habit – Mike

Paying yourself first isn’t easy, but it’s incredibly important for maintaining mental health and financial stability as an entrepreneur or creative professional. Making sure you put some money away each month—no matter how small—will add up over time and provide peace of mind knowing that if something unexpected arises, you’ll be prepared and won’t have to scramble for cash at the last minute! With these tips in mind, building a successful business where you always come first should become second nature!

comments +